Debt consolidation is a type of refinancing that describes the act of taking out one loan to pay off other loans and debts.

Real Example:

Bill has 5 credit cards, all of which he owes money on. For each card, Bill pays a seperate bill. Each card also has their own individual interest rates. Bill decides he wants to use one loan to pay off all of his bills. Now Bill only has to pay one bill with one interest rate. Way to go Bill!

Reasons to consolidate debt

The new loan used to pay off the other debts should have a lower interest rate and lower monthly payments.

Here are some common reasons debt consolidation might help your financial standing:

More Organized Finances

The number one step in getting control of your finances is organization. The option to consolidate multiple payments into one payment tremendously helps not only your current financial situation from an organizational standpoint, it also helps you better financially plan for the future.

Lower Interest Rate

Most credit cards have an interest rate between 15% to 20%. Depending on the interest rates of your credit cards, consolidating your credit into one loan with a lower interest rate could result in paying less money.

One of the first thing a loan officer looks at when discussing debt consolidations is how many lines of credit you have and what the interest rates are on each one. With that information, they can determine the best loan options to meet your financial goals.

Improve Credit Score

As strange as it may sound, taking out a loan to pay off other loans could help your credit score.

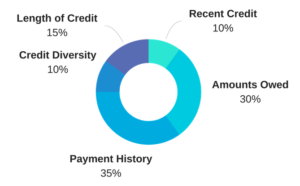

To fully understand why, it helps to be aware of the factors that affect your credit score. Here’s what you should know about your own credit score and what effects it.

- The commonly heard term FICO Score refers to a series of score factors that determine your overall credit score. The image shown on the right expresses the percentage each factor has on your FICO score.

- 10% of your FICO score is determined by how many credit lines you have opened.

- The best debt scenario with the most positive impact on your FICO score is to maintain at least 3 but no more than 4 lines of credit.

- There are two types of credits Revolving Credit and Installment Loans. If you want to know about the difference between the two you can check that out here. Creditors want to know how responsibly you manage a mix of credit types.

Real Example:

Bill has a credit score of 700 which is considered to be a decent credit score. (750 and above is where you want to aim) He has a total of 6 revolving credit accounts and 2 installment loans. His length of credit is great, about 6 years, he has never missed a payment, and he owes a manageable amount for his income. The only factor negatively affecting his credit from hitting the 750 – 850 mark is the total number of accounts. Bill decides to consolidate 3 of his revolving credit accounts into one account with a higher credit limit than his other credit lines. This allows him to address the issue of too many open credit lines while not affecting his credit allowance to utilization ratio.

Some frequently asked questions about debt consolidation:

What are the best ways to consolidate my debt?

This question is really defined by your debt and credit profile. Here are a few examples of debt consolidation options that may fit your situation

- Home Equity Debt Consolidation – This option is great for those who have a mid to high level of equity already invested in your home and are in good standing with your creditors. Check out our article on home equity debt consolidation for more information.

- Credit Card Debt Consolidation – Depending on the total amount of your debt, you can find good credit cards options that offer consolidation services with low or no interest for a given amount of time. If your strategy is to pay off your debts within a year, this may be a good option for you, however, interest rates tend to be much higher after the grace period. If your debts are to extensive to pay off in the alloted time, consolidating credit into one credit card may leave you in a worse situation than you started.

- Debt Consolidation Loan – Debt consolidation loans tend to offer lower interest rates than your average loan but they outway the low rates with an extended loan period. The goal is to pay the loan off much quicker by paying higher than the monthly minimum. You can use our debt consolidation calculator to test different rates and loan periods to match what fits your situation best,

Does debt consolidation hurt my credit score?

It really depends on your debt portfolio as a borrower. Technically, consolidating your debt is a form of new credit and will be viewed as such. In most cases, when you open a new line of credit it has an effect on your credit score. in the scenario of debt consolidation becoming a good option, the pro’s outway the con’s in regards to your long term credit health.

When should I consider consolidating my credit?

We continually advise that the best way to get control of your finances and grow is to get organize. Consolidating your debts into one line of credit allows you to simplify the organization of your payments and monthly budget. If you have multiple lines of debt with varying interest rates and are struggling to organize your finances, consolidating your debt into one payment will help create a payment strategy to destroy that debt for good.